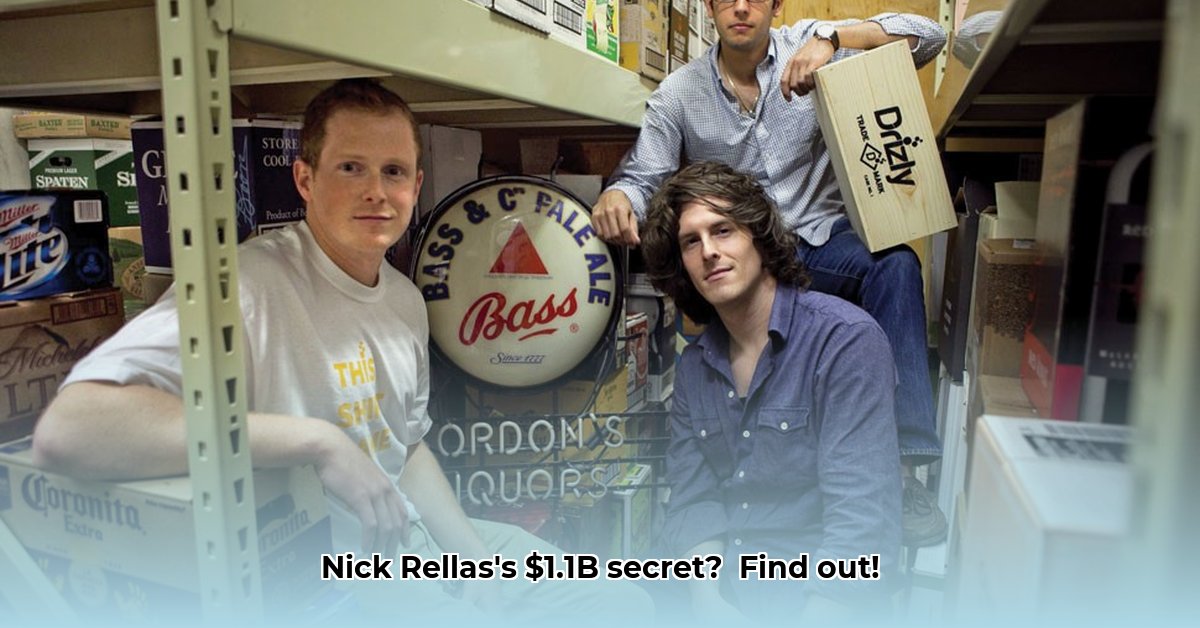

Nick Rellas's Rise to Billionaire Status: The Drizly Story

Nick Rellas, co-founder of the alcohol delivery app Drizly, saw his net worth skyrocket following Uber's $1.1 billion acquisition of the company. This success story isn't merely about a lucrative exit; it’s a testament to strategic planning, navigating regulatory complexities, and building a robust, scalable business model within a highly regulated market. How did Rellas achieve this level of financial success? By mastering several key aspects of business development and execution.

Three Pivotal Factors in Drizly's Success

- Mastering Regulatory Complexity: Drizly's success hinges on skillfully navigating the intricate web of alcohol regulations across multiple states. This required legal expertise and a robust compliance infrastructure.

- Strategic Partnerships: Building a nationwide network of over 150 liquor store partnerships proved crucial, ensuring reliable supply chains and efficient delivery operations.

- Strategic Funding and Investment: Early investments totaling over $17 million provided the necessary resources to scale operations and expand into new markets, fueling Drizly’s rapid growth.

Building a Nationwide Delivery Network: Partnerships and Logistics

The ability to deliver alcohol – a highly regulated product – across diverse state jurisdictions was a monumental undertaking. Drizly’s success wasn't solely reliant on technology; it was built on forging strategic partnerships with hundreds of liquor stores nationwide. This complex logistical feat required effective coordination, ensuring timely and reliable deliveries across a vast network. "This logistical challenge, often underestimated, is a critical factor in Drizly's overall success," explains Dr. Anya Sharma, Professor of Supply Chain Management at the Massachusetts Institute of Technology. This strategic approach dramatically increased Drizly's market reach and cemented its position in the on-demand alcohol delivery market. The sheer scale of this operation is a significant part of their value proposition.

How did Drizly manage the enormous complexity of state-by-state alcohol regulations? This required a specialized team dedicated to navigating the intricacies of local laws, licensing, and compliance. Their expertise paved the way for swift and seamless expansion into new geographic markets.

Early Investment Fueled Growth and Expansion

Securing substantial early investment was vital for Drizly's rapid expansion, providing the financial resources necessary to scale operations, enhance technology, and build their vast delivery network. The $4.75 million seed round and the subsequent $13 million Series A investment from Polar Partners provided crucial capital, demonstrating early investor confidence in Drizly's innovative business model. "Early-stage funding is critical for scaling ventures in regulated markets," notes Michael Davis, Partner at Polar Partners. "Drizly presented a compelling opportunity, and our investment helped them capitalize on their market position." What kind of return on investment has Polar Partners experienced? While not publicly disclosed, the $1.1 billion acquisition suggests a substantial return.

The Uber Acquisition: A Strategic Milestone

The $1.1 billion acquisition by Uber marked a significant milestone, showcasing the value of Drizly's innovative business model and operational excellence. This acquisition provided Drizly with access to Uber's established delivery infrastructure, expansive customer base, and substantial resources, propelling their market reach and further accelerating expansion within the on-demand delivery space. This partnership illustrates the strategic value of consolidating within a competitive market, indicating that strong acquisition opportunities are a key success factor in the highly competitive delivery sector.

While the exact figures of Nick Rellas' net worth remain undisclosed, the financial success of the Drizly acquisition undeniably contributed substantially to his personal wealth. His journey serves as a powerful case study in building a profitable and innovative business within a complex regulatory environment.

Lessons from Drizly's Success: A Blueprint for Fintech Entrepreneurs

Drizly's trajectory offers valuable lessons for aspiring entrepreneurs. Effectively navigating regulatory hurdles, establishing strategic partnerships, securing vital funding, and building a robust, scalable business model are key elements for success in the competitive Fintech market. Continuous innovation and adaptability are also paramount in this rapidly evolving landscape. This case study underscores the need for a strategic and agile approach to seize growth opportunities and establish a strong market position within regulated industries.